This post provides SaaS entrepreneurs with an Excel spreadsheet model and graphs that show the cash flow trough that happens to SaaS, or other subscription/recurring revenue businesses that use a sales organization. These kinds of SaaS businesses face a cash flow problem in the early days, because they have to invest up front in sales and marketing expenses to acquire customers, and only get payments from those customers over a delayed period of time. I refer to this phenomenon as the the SaaS Cash Flow Trough. The model also compares the cash flows of businesses that charge monthly to those that are able to charge their customers for a year’s payment in advance.

The greatest value from this post will come from downloading the model and inputting your own variables. The Excel Spreadsheet and associated PowerPoint file can be downloaded by clicking here. If you store both in the same directory, the PowerPoint graphs can be updated to reflect the data in the spreadsheet by right clicking on each graph, and selecting “Edit data”.

Part 2 of this series can be found here: SaaS Economics – Part 2: Scaling the Business.

Where is this applicable?

This model is applicable to any recurring revenue business that uses a sales force.

This model does NOT apply to SaaS businesses that don’t use a sales force. I refer to those businesses as having a “touchless conversion”, as there is no sales touch involved. Those businesses usually have a far lower investment in sales and marketing expenses, and become cash flow positive far earlier.

What are the different analyses?

The model looks at the following different analyses, and each is described in this blog post with graphs:

How bookings accumulate over time

The effect of churn

The three components of MRR (monthly recurring revenue)

Cash flows for an individual sales person

The marketing costs of providing a sales person with enough leads

Cost to acquire a customer

Lifetime value of a customer

In part 2 of this blog post series, The second part of the model looks at what happens when a SaaS company has reached the point of a repeatable, scalable sales model, and wants to start ramping their sales and marketing spend to grow revenues.

The last part of this blog post discusses how the model was built, and how to use it for your own calculations.

Part 1: Looking at a single new sales hire

How revenue builds for a single sales hire, assuming no ramp up time

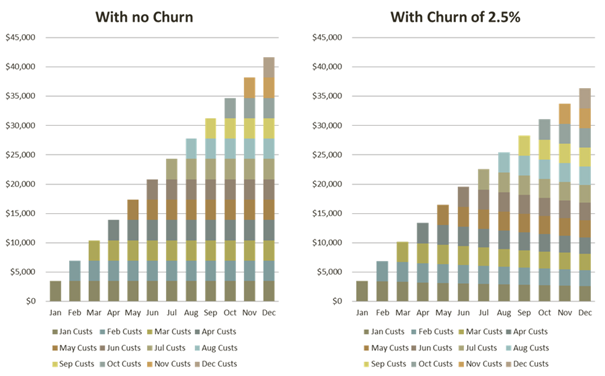

For those new to SaaS or other recurring revenue businesses, the graph below shows one of the delightful things about recurring revenue. Bookings made in January, continue to be billed in every subsequent month. The chart on the left shows this effect assuming no churn rate (or loss of customers). The graph on the right shows the impact of a 2.5% monthly churn rate, which slowly eats away amount that billed monthly.

Bookings, Churn, and MRR for a new sales hire

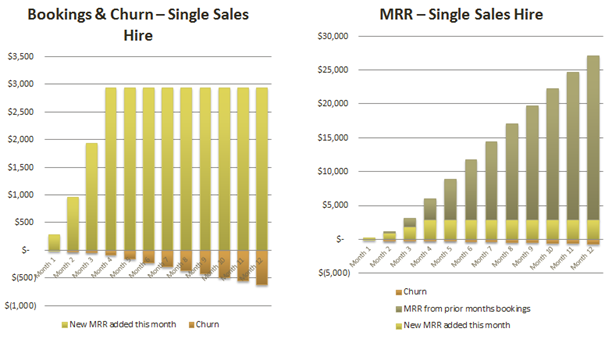

The above graphs assume no ramp up time. Lets take a look at bookings, churn, and MRR for a new sales hire:

The graph on the left shows how new monthly bookings ramp, and how churn builds up over time. The graph on the right shows MRR (Monthly Recurring Revenue) which increases every month by the new bookings, and decreases by the churn. For experienced SaaS business people, this MRR graph is probably obvious, however for those new to SaaS, it is worth clearly understanding the three different components of MRR.